A new wave of Covid-19 has washed across the world in 2021, with negative impacts on figures globally. Countries are facing varying levels of urgency, depending on their vaccination roll-outs and the development of the new variants.

Indeed, new variants continue to emerge. Such new variants—UK’s B1.1.7, South Africa’s B.1.351, Brazil’s P.1. and India’s B1.1.617—are usually not more lethal, but typically are more contagious.

Brazil and India, for example, are currently paying a heavy toll. New variants have annihilated hopes of a swift recovery for these populations.

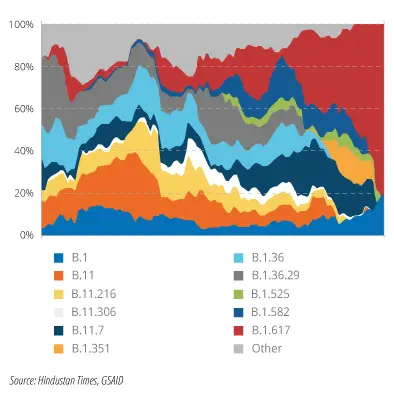

In India, the resurgence of new cases in March coincided with the emergence of a new variant in the country, labelled "B.1.617". It is so much more transmissible that the strain represented less than 5% of new cases at the beginning of March, but more than 80% of new cases by the beginning of April.

Exhibit 1: The variants prevalence in India

With only 1% of the population fully vaccinated, the spike in cases in India appears to be linked more to the low rate of vaccination rather than the ability of the new strain to evade the effect of vaccination. Indeed, the two key mutations of the Indian variant, L452R and E484Q, are present in other strains such as the UK and South African variants, for which a number of vaccines remain effective (Pfizer, Moderna, J&J and Covaxin).

The same deadly issue occurs in Brazil, which accounted for 24% of the world’s Covid-related deaths in March. With only 12% of the Brazilian population vaccinated, mainly with a vaccine (Sinovac) shown to be ineffective against the Brazilian mutation, Brazil is suffering the consequences of an ineffective vaccine combined with a severe strain.

To a lesser extent, developed countries are also facing an upsurge in cases. Japan recently declared a new state of emergency until 11 May in Tokyo and three other prefectures, to curb new cases and protect the Olympic games scheduled for the end of July.

In the U.S. and Europe, the pandemic appears to be contained by accelerated vaccine deployment and the hope – so far - of no new aggressive variants.

Covid-19 cases in the U.S. have declined by 83% from their peak, but rose again by 49% since 21 March. Despite concern over a new variant discovered recently in Texas, labelled BV-1 for its origin in the Brazos Valle, the first threshold of herd immunity (70%) could be within reach in coming months. Over 200 million doses of vaccine have been administered to a population of roughly 330 million.

In Europe, the pace of vaccination has also accelerated in recent weeks. Nearly 28% of the population across the Euro Area 4 (Germany, France, Italy and Spain) has received at least their first vaccination, which has been credited with the 39% decline in new Covid-19 cases since the peak of last year. Although a new wave began in February 2021, cases are already beginning to stabilise and even decline in Italy and France. Vaccine supply had been the bottleneck in recent months. Considering the distribution improvement, the European Commission’s goal of vaccinating 70% of the adult population by late September could be achieved sooner rather than later – perhaps even by the end of July.

The heterogeneous evolution of this pandemic has been reflected in the financial markets. Brazilian and Indian markets have been hit hard, with year-to-date equity market underperformance through

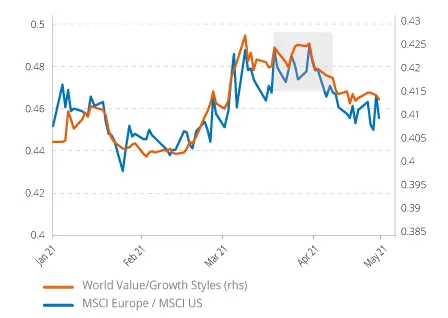

The financial market effect has been even more striking in the US. The outbreak of new hospitalizations, followed by the fall in high-frequency data at the beginning of April, were among the triggers for the turnaround in US rates and the halt in the market's value style rotation.

Exhibit 2: Evolution of US hospitalizations and 10-Year US Treasuries

Exhibit 3: Evolution of high frequency data on US seated dinners vs 10-Year US Treasuries

Exhibit 4: Evolution of the Growth / Value trade

Continued new mutations -- possibly rendering existing vaccines less effective -- and their spread to other countries remain a challenge around the world. It is a downside risk that we cannot ignore, and one which the market keeps very much in mind.

Considering the efficiency (mostly of the RnA vaccines) and swift roll out (with immunity due soon) of the vaccine in the US and Europe, a continued acceleration of growth over the coming months remains the most likely case. Therefore, we believe US Treasuries should resume their trend toward higher yields, triggering a further rotation out of growth, quality and defensives to value and cyclicals, which are overrepresented in European markets.

1 From 04.03.2021 to 23.04.2021